The Investing Conundrum : Where to park your savings?

It is a question that troubles everyone with savings.

Where to invest?

When you open the proverbial financial news, there are negative signals flying all around.

Global Economy that is propped up by spending on AI, Automotive market share that is once again up for grabs due to the rise in very competitive Chinese EV offerings, global conflicts which are still ongoing, a world that is beginning to reverse the winds of free trade et all

This has a severe knockoff effect on private corporations when it comes to planning their spending which leads to one thing - wait and see which has plenty of known and unknown consequences for different sectors of the global economy.

However, all of this is noise. If we zoom out and look at the bigger picture, we see two large trends :

1) The direction of the future is informed by billion dollar deals not 100 billion dollar deals :

- Google acquiring Youtube for $1.6B in 2006

- Facebook acquiring Instagram for $1B in 2012

- Microsoft's Investment in OpenAI worth ~$1B in 2019

In the same timeframe, the following deals also happened/in progress :

- AT&T and Time Warner : ~$85B in 2018

- Netflix and Warner Bros : $82B (In Progress)

Out of these two categories, you should be able to make out which one of these cohorts have had a larger impact on global markets - that should tell you about how to assess future trends.

2) In the grand scheme of things, it is not all that bad :

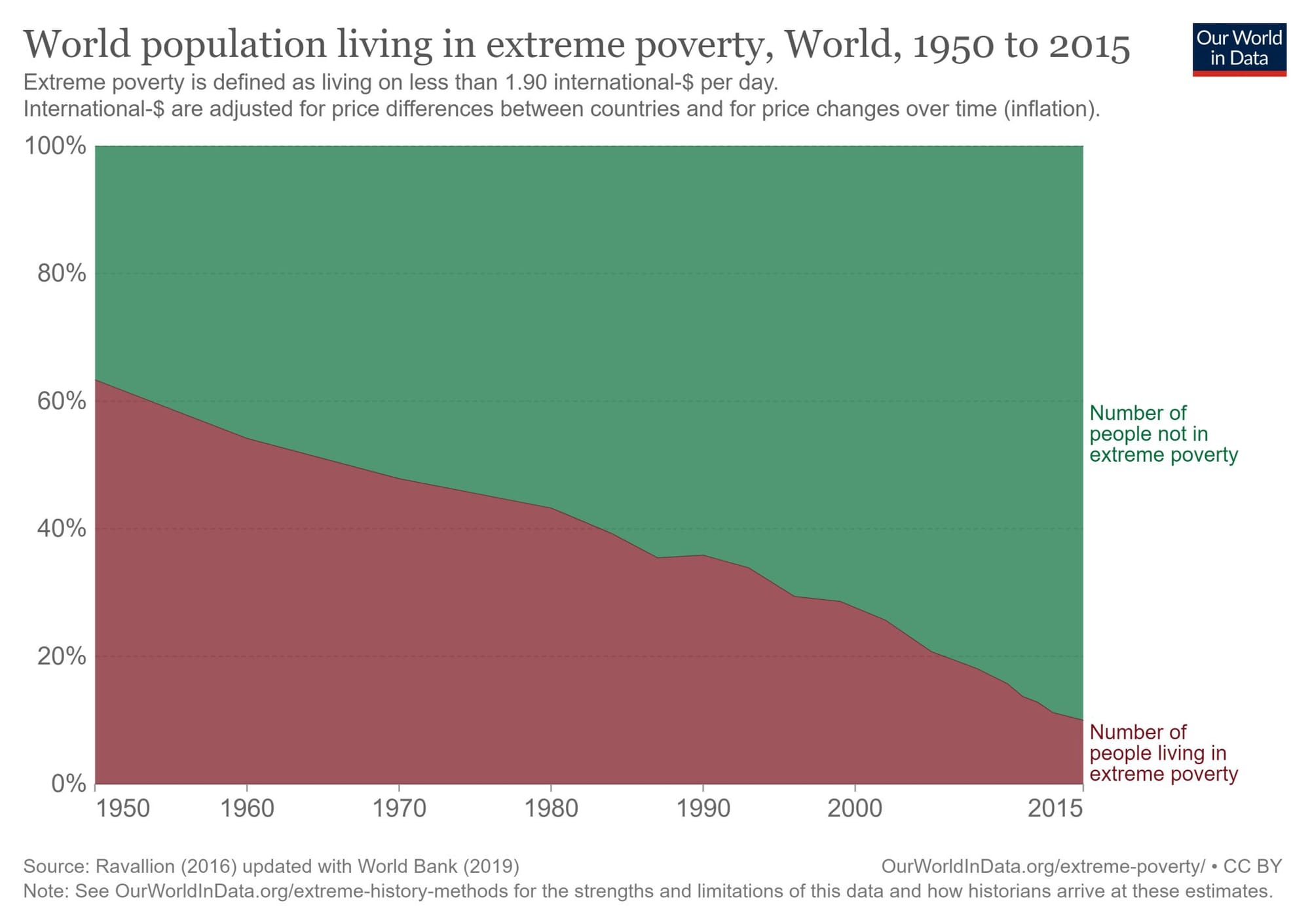

If you zoom out and look at human progress over the last half century, it is nothing short of a miracle. There has been a relentless rise in average lifespan on account of better healthcare, extreme poverty has fallen down drastically.

Countries that were struggling to ensure basic necessities for their citizens are now in a position to compete on high-tech with the West - South-East Asia, China and too an extent India as well.

History may not repeat itself but it keeps on rhyming repeatedly in different ways over time. India and China are well on their way to reclaim the top 2 rungs on the global economic order as has been the case for the vast majority of the previous 2 millennia with the United States being a competitive third.

This is how you should structure your bets.

United States has natural advantages in the technology space with the FAANG Companies already well established in global markets and smooth roads in front of them, they should continue to dominate the landscape especially Alphabet, Amazon and Microsoft.

This can be supported by R&D focused enterprises in the Pharmaceutical Space whose need will continue to increase as incomes continue to rise and people place an ever-increasing focus on living their life well.

For the consumption and secondary tech part, India can be your go-to destination. There are multiple SaaS Startups doing really well along with the old economy companies like FMCG, Telecom and Healthcare. A sizeable allocation to equities in India and the U.S. along with a small proportion in fixed income instruments seems like a fair choice for the future.